Could a USA Lawsuit Wipe Out Your Savings? How to Stay Protected

In todays litigious society, a single lawsuit can threaten your hard-earned savings. Whether you're a business owner, professional, or even an average wage earner, legal actions can arise from unexpected placescar accidents, business disputes, or even a slip-and-fall claim on your property.

The question isntifyou could face a lawsuititswhenandhow badlyit could impact your finances. The good news? With the right strategies, you can safeguard your savings before disaster strikes.

Why Lawsuits Are a Real Threat to Your Savings

The U.S. is one of the most litigious countries in the world. According to recent data:

-

Over40 million lawsuitsare filed annually in the U.S.

-

The averagepersonal injury settlementexceeds$50,000.

-

Business-related lawsuits can easily exceedsix or seven figuresin damages.

If you lose a case and lack protection, creditors can go after your:

-

Bank accounts

-

Investments

-

Real estate

-

Future earnings

Even if you win,legal defense costs alonecan drain your savings.

How Lawsuits Can Target Your Assets

1. Personal Liability Risks

-

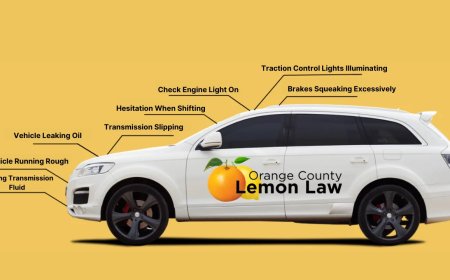

Auto accidents: If youre at fault in a crash, victims can sue for medical bills, lost wages, and pain/suffering.

-

Homeowner liabilities: A guest injured on your property could file a claim.

-

Professional mistakes: Doctors, contractors, and consultants face malpractice or negligence suits.

2. Business-Related Vulnerabilities

-

Contract disputes: Vendors or clients may sue for breach of agreement.

-

Employee lawsuits: Wrongful termination or discrimination claims can be costly.

-

Debt collection: Unpaid business loans may lead to asset seizures.

3. Unforeseen Legal Threats

Even frivolous lawsuits can force you into costly settlements just to avoid prolonged court battles.

5 Ways to Protect Your Savings from Lawsuits

1. Maximize Insurance Coverage

Insurance is yourfirst line of defense:

-

Auto & Home Insurance: Ensure high liability limits (e.g., $500K+).

-

Umbrella Policies: Adds extra coverage (often $1M+) beyond standard policies.

-

Professional Liability Insurance: Essential for doctors, lawyers, and consultants.

Tip:Regularly review policiesunderinsurance is a common mistake.

2. Shield Assets Through Legal Structures

Certain financial structures offer lawsuit protection:

-

Retirement Accounts (401(k), IRAs): Often protected under federal/state laws.

-

Trusts: Irrevocable trusts can separate assets from personal ownership.

-

Business Entities: LLCs or corporations can limit personal liability for business debts.

Warning:Fraudulent transfers (moving assetsaftera lawsuit is filed) are illegal. Plan ahead.

3. Homestead Exemptions

Many states protectprimary home equityfrom creditors. For example:

-

Texas & Florida: Unlimited homestead protection.

-

California: Protects up to $600,000 in home equity.

Check your states lawssome require filing for the exemption.

4. Keep Personal and Business Finances Separate

-

Never mix personal and business accounts.

-

Use separate credit cards and legal entities (e.g., an LLC for side hustles).

5. Stay Judgement-Proof (When Possible)

If you have minimal assets, creditors may find it pointless to pursue you. However, this isnt a reliable long-term strategy.

What to Do If Youre Already Facing a Lawsuit

-

Dont Ignore It: Default judgments can freeze your accounts.

-

Consult a Lawyer: Specialized attorneys can negotiate settlements or asset protection.

-

Document Everything: Keep records of communications and financial transactions.

-

Explore Settlements: Sometimes, settling early is cheaper than a trial.

Final Thoughts: Proactive Protection Beats Reactive Panic

No one expects a lawsuit until it happens. The key isplanning aheadwhether through insurance, legal structures, or smart financial habits.

Atuorni, we believe in empowering individuals with knowledge to secure their financial future. Dont wait until its too latetake steps today to protect what youve worked so hard to build.